Cryptocurrency Market Analysis : The world of digital finance is rapidly evolving, and one of the most dynamic sectors within it is cryptocurrency. With thousands of digital coins and tokens now circulating in the global marketplace, understanding how these assets behave is more important than ever. That’s where cryptocurrency market analysis becomes essential.

For anyone looking to enter or navigate the crypto world, market analysis offers a roadmap—one that combines data, patterns, sentiment, and forecasts to guide smarter investment decisions. Whether someone is a day trader or a long-term holder, being able to analyze the market effectively is crucial for managing risk and maximizing returns.

This in-depth article explores everything there is to know about cryptocurrency market analysis, from its types and tools to the real-world applications and common mistakes investors must avoid.

What is Cryptocurrency Market Analysis?

Cryptocurrency market analysis refers to the methods used to evaluate digital assets in order to understand their potential movement and overall market behavior. Just like with traditional financial markets, analyzing the crypto market helps investors identify when to buy, hold, or sell their digital currencies.

There are primarily two types of analysis used in the crypto market:

- Technical Analysis

- Fundamental Analysis

In some cases, a third approach—sentiment analysis—is also considered to gain a better perspective on the overall market mood.

Technical Analysis: Reading the Charts

Technical analysis (TA) is the practice of using historical price data, patterns, and trading volume to predict future price movements. Crypto traders often rely on various tools and indicators to help them determine the best times to enter or exit trades.

Key Technical Indicators in Crypto

- Candlestick Patterns – These are visual representations of price movements over time. Patterns such as hammers, engulfing candles, and doji patterns often signal reversals or continuations.

- Moving Averages – These smooth out price data to help spot trends. Common types include:

- Simple Moving Average (SMA)

- Exponential Moving Average (EMA)

- RSI (Relative Strength Index) – Measures momentum and determines whether an asset is overbought or oversold.

- MACD (Moving Average Convergence Divergence) – Indicates trend direction and momentum.

- Volume – High trading volume usually confirms the strength of a trend, while low volume could indicate a possible reversal.

By combining these indicators, traders can develop strategies that fit their risk tolerance and market view.

Fundamental Analysis: Looking Beyond the Charts

Unlike technical analysis, which focuses solely on numbers and patterns, fundamental analysis (FA) delves into the underlying value of a cryptocurrency. It evaluates the project’s purpose, team, use case, and other essential metrics.

Elements of Fundamental Analysis in Crypto

- Whitepapers – Every legit crypto project begins with a whitepaper that outlines its vision, technical framework, and tokenomics.

- Team and Development – The credibility and experience of the team behind a project can significantly impact its success.

- Token Supply Metrics

- Maximum Supply

- Circulating Supply

- Inflation Rate

- Community and Ecosystem – A strong, active community and robust ecosystem of developers can be strong indicators of long-term success.

- Partnerships and Integrations – Collaborations with other companies and platforms can validate a project’s credibility and boost adoption.

Fundamental analysis is crucial for long-term investors looking to hold assets beyond short-term price fluctuations.

Sentiment Analysis: The Psychology of the Market

While technical and fundamental analyses are based on data, sentiment analysis is about understanding the emotions driving the market.

How Sentiment Shapes Crypto Markets

Crypto is a highly emotional market influenced by:

- News and media headlines

- Social media trends

- Influencer opinions

- Fear, uncertainty, and doubt (FUD)

- Fear of missing out (FOMO)

Tools like LunarCrush, Santiment, and CryptoPanic track social mentions and sentiment trends to give traders an edge.

Importance of Cryptocurrency Market Analysis

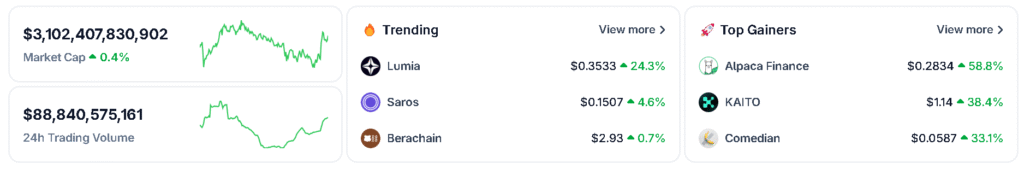

Why should anyone bother analyzing the crypto market? The short answer: volatility.

The cryptocurrency space is notorious for its price swings. Bitcoin, for instance, can gain or lose thousands of dollars in value within hours. A well-rounded cryptocurrency market analysis approach helps:

- Identify opportunities early

- Avoid costly mistakes

- Plan entry and exit strategies

- Understand macro and microeconomic influences

Influential Factors in the Crypto Market

There are several macro and micro-level elements that affect the prices of cryptocurrencies. Knowing what drives the market can complement your analysis.

1. Regulatory Changes

Governments around the world continue to release statements and laws regarding digital currencies. News of regulation (or lack thereof) can lead to dramatic price swings.

2. Technological Developments

Network upgrades (like Ethereum’s shift to proof-of-stake), fork events, and new integrations can significantly affect a coin’s value.

3. Market Liquidity

Higher liquidity usually means more stable prices. Low liquidity can lead to extreme volatility, especially for lesser-known altcoins.

4. Institutional Investment

As major institutions like BlackRock, Fidelity, and Tesla enter the crypto market, their buying and selling behavior has a substantial impact on prices.

5. Global Events

Economic crises, inflation, interest rate hikes, and even political tension can indirectly influence crypto markets by affecting investor sentiment.

Tools for Cryptocurrency Market Analysis

Having the right tools makes market analysis much easier. Here are some essential platforms used by analysts and traders:

| Tool/Platform | Purpose |

|---|---|

| TradingView | Charting and technical indicators |

| CoinMarketCap | Market cap, rankings, price data |

| CoinGecko | Coin metrics and token info |

| Glassnode | On-chain data and analytics |

| IntoTheBlock | Wallet analysis, investor behavior |

| LunarCrush | Sentiment analysis and social trends |

| CryptoPanic | News aggregation and sentiment |

How Beginners Can Start with Market Analysis

If someone is just starting out with cryptocurrency market analysis, it can feel overwhelming. Here’s a simple roadmap to get started:

- Educate Yourself – Read about technical and fundamental analysis. Plenty of free resources and tutorials are available online.

- Practice With Simulators – Platforms like eToro and TradingView offer demo accounts where one can practice without risking real money.

- Track a Few Coins – Instead of jumping into dozens of coins, start by analyzing major ones like Bitcoin and Ethereum.

- Set Goals and Strategy – Are you looking to day trade or invest long term? Your strategy will depend on this.

- Use Alerts and Automation – Tools like CoinMarketCap alerts or automated bots can help monitor price movements and reduce emotional trading.

Strategies Based on Cryptocurrency Market Analysis

Analysis isn’t just for academic curiosity—it’s the foundation of smart investment strategies. Here are a few common strategies based on market analysis:

1. Trend Following

Based on technical analysis, this strategy involves entering trades in the direction of the current trend (uptrend or downtrend).

2. Buy the Dip

Using both technical and sentiment analysis, this strategy involves buying assets after price corrections.

3. HODLing

This long-term approach is supported by fundamental analysis. Investors buy solid projects and hold them despite market volatility.

4. Swing Trading

A medium-term strategy where traders buy and sell based on price swings, using TA and short-term FA.

Common Mistakes in Market Analysis

Even with the best tools, mistakes can happen. Here are common pitfalls to avoid:

- Ignoring Market Sentiment – TA and FA may be solid, but ignoring sentiment could result in bad timing.

- Overanalyzing – Sometimes too much information causes paralysis. Stick to a few key indicators.

- Neglecting News and Events – Failing to consider breaking news can invalidate technical setups.

- Chasing the Market – Reacting emotionally instead of strategically often leads to losses.

- Not Having a Plan – Without defined entry, exit, and stop-loss strategies, investors are left to improvise under pressure.

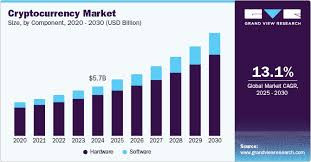

The Future of Cryptocurrency Market Analysis

As the crypto market continues to mature, so will the tools and methods used to analyze it. In the future, we can expect:

- AI and Machine Learning – These technologies are already being used to build predictive models.

- Integration with Traditional Finance – As Wall Street firms continue to enter the space, more traditional analysis models may be adopted.

- Regulatory Clarity – With clearer regulations, market reactions may become more predictable.

- Deeper On-Chain Analytics – Tools that analyze blockchain activity will become more user-friendly and data-rich.

Final Thoughts

In an environment as fast-moving and unpredictable as the cryptocurrency space, analysis is more than just helpful—it’s essential. Through the combination of technical charts, fundamental insights, and emotional pulse checks, cryptocurrency market analysis equips individuals to navigate the highs and lows of digital investing.

For those willing to put in the time to learn, apply, and adapt, the rewards of understanding the crypto market can be substantial. Whether one is a casual observer, a seasoned investor, or someone just beginning their crypto journey, mastering the art of market analysis can make all the difference.